BUSINESS

Furlough 2.0

The Prime Minister has announced the furlough scheme will now be extended until 31st March 2021 to support businesses and workers as we head into the second lockdown. This will replace the proposed Job Support Scheme.

LATEST UPDATE (DEC 2020):

Chancellor Rishi Sunak has announced that the Coronavirus Job Retention Scheme (CJRS) is being extended to the end of April 2021.

ARE THERE ANY DIFFERENCES TO THE ORIGINAL SCHEME?

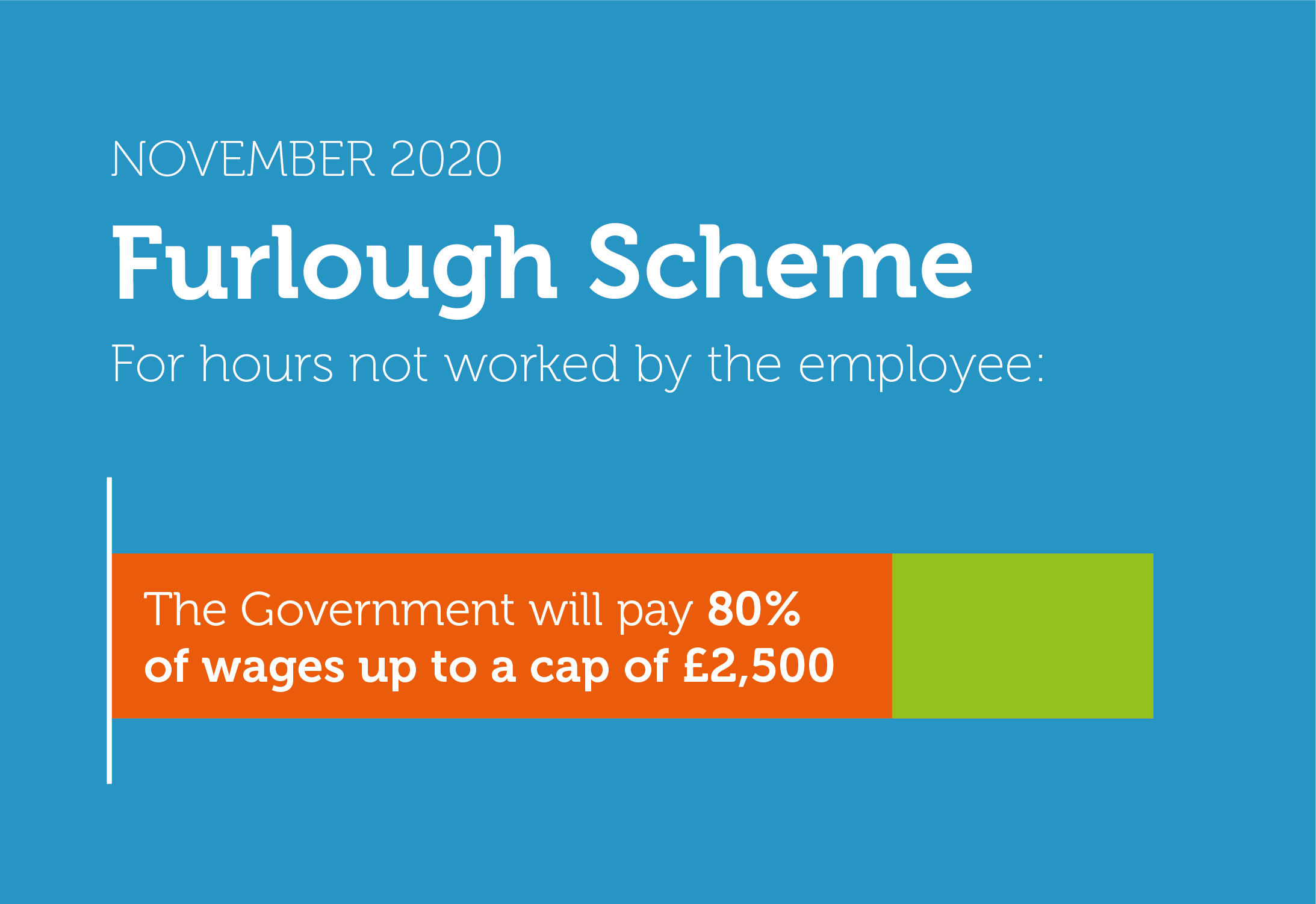

The scheme is similar to how it was at the beginning – employees will receive 80% of their wages unless topped up to 100% by their employer. However, whereas previously the employer contributed 20% with the government topping up the remaining 60%, the government will now cover the full 80% (up to £2,500 per month). The employer will only be required to cover pension and national insurance contributions. This will run until January, where it will be reviewed by the government and they may ask employers to contribute more.

From December 2020, HMRC will publish the names of companies and Limited Liability Partnerships (LLPs) who have made claims under the scheme for the month of December onwards.

WHAT ARE THE REQUIREMENTS?

An employee can be furloughed if:

- The employee has been instructed by you to cease all work in relation to their employment

- The reason for the instruction to cease work was due to circumstances of the coronavirus

The employer and employee must have agreed in writing that the employee will cease work.

We have advised a step-by-step process that you can follow.

SELF EMPLOYED - SEISS GRANT

From the 30th November 2020 the third self-employment grant will be available for the self-employed, covering the period 1 November 2020 to 31 January 2021. The grant will now be a single payment of 80% of average trading profits, up to a maximum of £7,500 for that period.

This is a significant increase from originally proposed 55% of average trading profits, which would have included 80% of average profits in November only, then up to 40% of average profits in December and January, up to a maximum of £5,160.

MORTGAGE HOLIDAYS

Mortgage payment holidays have been extended. Borrowers that have already started a mortgage payment holiday will be able to top up to six months without this being recorded on their credit file.

Borrowers who have been impacted by coronavirus and have not yet had a mortgage payment holiday will be entitled to a six month holiday.